State refund estimator

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. For tuition fees related to TN eCampus see the information at the TN eCampusinfo website.

How To Calculate Income Tax In Excel

Important Information for the one-time Middle Class Tax Refund payment is now available.

. This is because the outstanding taxes you owe to the IRS always needs to be paid first. If you get a larger refund or smaller tax due from another tax preparation method well refund the applicable TurboTax federal andor state purchase price paid. Arizona State University awards scholarships to incoming first-year students with outstanding academic ability upon admission to ASU each fall semester.

Estimate Your 2022 Tax Refund For 2021 Returns. Fee Adjustment Refund Policy. The refund date youll see doesnt include the days your financial institution may take to process a direct deposit or a paper check may take in the mail.

Maps and Locations. California Tax Calculator - Quick Tax Estimator. Statelocal and property taxes capped at 10000 - 0 for Standard.

Because some members may retire at a relatively early age with a high percentage of highest average final compensation a few may encounter this limit. Gross Income F1040 L7-21. You can not eFile Forms to the IRS or State from DocuClix.

Remember this is just a tax estimator so you should file a proper tax return to get exact figures. The 2022 tax values can be used for 1040-ES estimation planning ahead or comparison. POPULAR FORMS.

Calendar Aid and Billing Calendar. August 11 2022 - The Minnesota Department of Revenue reminds homeowners and renters to file for their 2020 Property Tax Refund before the deadline of August. Use this calculator to help determine whether you might receive a tax refund or still owe additional money to the IRS.

The tax rates calculated using the Property Tax Estimator Program may change once taxing authorities budgets are certified in September. This scholarship estimator tool can help determine the amount of scholarship money that you may be eligible to receive. And is based on the tax brackets of 2021 and 2022.

If you attempt to use the link below and are unsuccessful please try again at a later time. Instructions for Form 1040 Form W-9. Summer maintenance and out-of-state tuition fees are assessed on a per credit hour basis with no set maximum.

Property Tax Estimator Notice The Michigan Treasury Property Tax Estimator page will experience possible downtime on Thursday from 3PM to 4PM due to scheduled maintenance. Welcome to our Australian Tax Refund calculator. TurboTax Online Free Edition customers are entitled to payment of 30.

Calculate your total tax due using the CA tax calculator update to include the 202223 tax brackets. This calculator is FREE to use and will give you an instant Australian tax refund estimation. Individual Tax Return Form 1040 Instructions.

R Block desktop software solutions to prepare and successfully file their 2021 individual income tax return federal or state. California will provide the Golden State Stimulus II GSS II payment to families and individuals who qualify. This 2021 Tax Return and Refund Estimator provides you with detailed Tax Results during 2022.

If you use Guest Services select Wheres My Refund and you will be asked to enter the following information for security reasons. Choose a different State. 202223 California State Tax Refund Calculator.

If youve ever worked Down Under you probably paid tax and are due an Australian tax refund. Will I get a refund or owe the IRS. This payment is different than the Golden State Stimulus I GSS I.

If youre concerned contact the Georgia Department of Revenue. Internal Revenue Code Section 415b imposes a dollar limit on the benefit amount the Maryland State Retirement Agency can pay from tax-deferred plan funds. The Estimator Program also cannot account for special school levies which may be approved by voters in August.

Then get Your Personal Refund Anticipation Date before you Prepare and e-File your 2021 IRS and. The Tax Withholding Estimator doesnt ask for personal information such as your name social security number address or bank account numbers. Answering a few questions about your life income and expenses with our tax calculator will answer the questions we all want answers to.

15 Tax Calculators. See the Middle Class Tax Refund page. Manage Account Payment Options Tuition Refund ASU Payment Plan Budget Worksheet.

Research estimates of how state House and Senate bills could affect revenues and the Minnesota tax system. Deduct the amount of tax paid from the tax calculation to. We dont save or record the information you enter in the estimator.

Tuition Estimator Cost of Attendance Tuition and Fees. For details on how to protect yourself from scams see Tax ScamsConsumer Alerts. Tax Refund Estimator For 2021 Taxes in 2022.

This information is for general guidance only. TUITION AND FEES SUBJECT TO CHANGE BY THE ETSU BOARD OF TRUSTEES WITHOUT NOTICE. Treasury Secretary of State UnemploymentUIA 2.

Request for Taxpayer Identification Number TIN and Certification. Filed your 2020 taxes by October 15 2021. If you have previously established a MILogin account you may use the same username and password for multiple state agency access.

Students are evaluated for ASU merit scholarships through May 1st. It is mainly intended for residents of the US. Urgent energy conservation needed Raise your AC to 78 after 3pm.

Contact and Forms Contact Disclosures FAQs Find a Form. To qualify you must have. However Arizona State University reserves the right to increase or modify tuition and fees without prior notice upon approval by the Arizona Board of Regents or as otherwise consistent with Board policy and to make such modifications applicable to students enrolled at ASU at that time as well as to incoming students.

As much as we would like to help TurboTax does not distribute refunds only the IRS or your state tax agency can legally do so. For example if you owe taxes for a prior year but expect a tax refund in the current year the federal government doesnt view this as an. Before any other federal or state agency can garnish your tax refund you must be current on your federal income tax payments.

Maximum Refund Guarantee Maximum Tax Savings Guarantee - or Your Money Back. Check if you qualify for the Golden State Stimulus II.

Tax Calculator Estimate Your Taxes And Refund For Free

Tax Calculator Estimate Your Taxes And Refund For Free

Tax Year 2022 Calculator Estimate Your Refund And Taxes

How To Calculate Income Tax In Excel

Australian Tax Calculator Excel Spreadsheet 2022 Atotaxrates Info

Tax Refund Calculator 2020 2021 Tax Return Estimator Industry Super

Tax Return Calculator How Much Will You Get Back In Taxes Tips

Cash App Taxes 100 Free Tax Filing For Federal State

Excel Formula Income Tax Bracket Calculation Exceljet

Tax Refund Estimator Hotsell 53 Off Www Wtashows Com

Tax Calculator Estimate Your Taxes And Refund For Free

Tax Return Calculator How Much Will You Get Back In Taxes Tips

Tax Return Calculator Online 60 Off Www Wtashows Com

How To Calculate Your Federal Income Tax Liability Personal Finance Series Youtube

Tax Calculator Refund Return Estimator 2021 2022 Turbotax Official

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

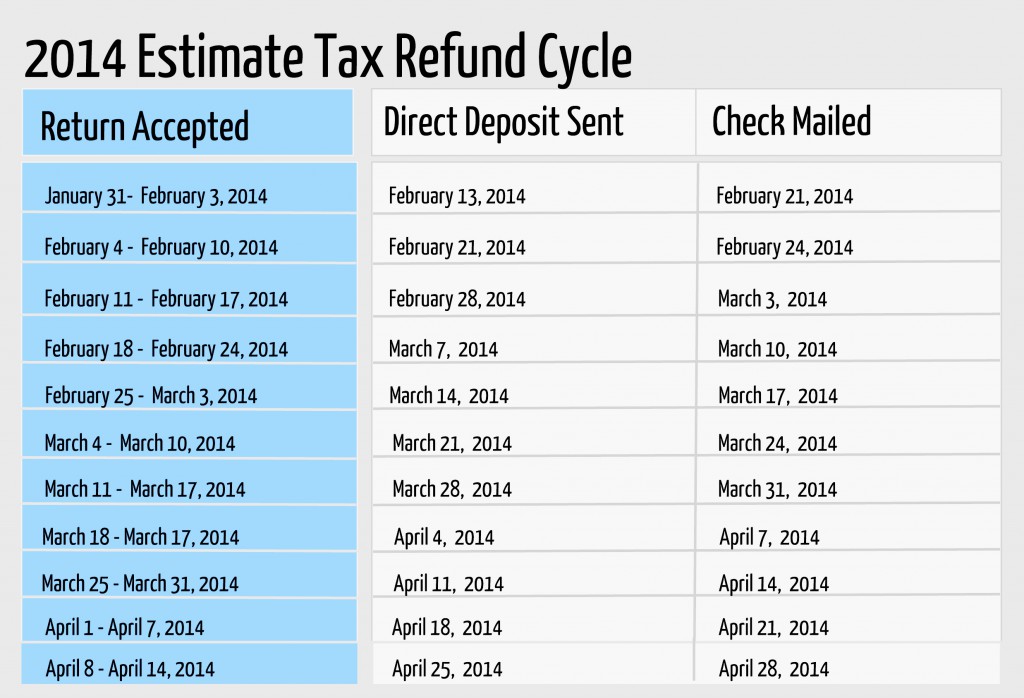

Estimated Income Tax Refund Date Chart For 2022